Your business growth. Guaranteed.‡

For Advisors

Choice, right from the very start

One size never fits all. Cetera gives you multiple ways to affiliate, plus additional options within each model to help you find the perfect fit.

Onboarding

Benefit from less work and more flow thanks to a technology suite designed to streamline the process and the paperwork.

AdviceWorks® streamlines account opening, reduces errors, and provides your clients with a digital portal to their accounts once transferred.

Efficiently coordinate with your onboarding coach through SmartSheet with unlimited access to your action log, dashboard, and client tracker.

Enjoy simplified data preparation prior to onboarding through our engagement with our partners, setting you up for success from the outset.

Your Accesslink experience manager and coach will work with you until your onboarding is complete to your satisfaction.

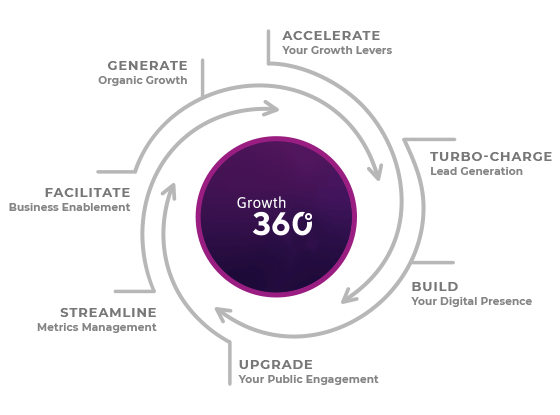

Growth360 | Financial Institutions

Our structured, repeatable approach makes growth attainable for any advisor at any time.

Keep everyone on top of their action plan with a digital dashboard to track individual progress toward unique goals.

Each of your advisors will get paired with a dedicated Growth Officer for one-on-one support throughout their journey.

Advisors will leverage peer-proven methods to stay on target for their growth goals, using custom plans built just for them.

Cetera’s extensive suite of resources are tailored to your advisors’ specific needs by their Growth Officer.

Growth360

Our structured, repeatable, approach makes growth attainable for any advisor at any time.

Keep on top of your action plan with a digital dashboard to track your progress toward your goals.

Get paired with a dedicated Growth Officer for one-on-one support throughout your journey.

Leverage peer-proven methods for increasing the value of your business, using a plan built just for you.

Draw from Cetera’s extensive suite of resources, tailored to your specific needs by your Growth Officer.

Advanced Time Segmentation | Financial Institutions

Designed to be spent down over five to seven years and buy time for the Future Income segment to grow.

Bridges the Immediate Income and Long-Term Growth segments to provide additional time for a client’s long-term investments to grow.

While the first two segments have provided short- and mid-term income, this segment is designed to grow untouched for several years and is calculated to address risk.

For conservative clients or those who believe they have a long life expectancy, this segment offers guaranteed inflation-adjusted income for life.

Designed to provide supplemental income and growth for the portfolio over the long-term, this segment can include alternative investments.

Advanced Time Segmentation

Designed to be spent down over five to seven years and buy time for the Future Income segment to grow.

Bridges the Immediate Income and Long-Term Growth segments to provide additional time for a client’s long-term investments to grow.

While the first two segments have provided short- and mid-term income, this segment is designed to grow untouched for several years and is calculated to address risk.

For conservative clients or those who believe they have a long life expectancy, this segment offers guaranteed inflation-adjusted income for life.

Designed to provide supplemental income and growth for the portfolio over the long-term, this segment can include alternative investments.

Legacy Builder

Ensure the purchase of your business should you experience an unplanned exit from your practice.

Build your enterprise value while simultaneously developing a successor of your choice.

Expand your business through streamlined acquisitions featuring personalized introductions and guidance throughout the transition.

If you can’t find a suitable buyer or your business is especially large or complex, we will purchase it from you.

Compliance

Enjoy direct access to our head of supervision, chief compliance officer, and chief risk officer for support and to understand the “why” behind our practices.

Our timely communications keep you up-to-date on policy changes and provide practical guidance for any hurdles you may face.

Leverage leading-edge tech tools, like Pinpoint Global, to simplify tasks and manage compliance demands.